Compound Interest: What Is It And How It Works

Compound interest is when you earn interest not only on the initial amount, but also on the interest you have already received on this amount. It looks like a bank deposit with capitalization.Compound Interest is the most powerful force in the universe

Albert Einstein

Examples of regular and compound interest:

You have $ 1000 and you put it on a deposit at 10% per annum. Your income will be $ 100 per year. Now let's calculate with compound interest.

You have $ 1000 and you deposit it at 10% per annum, but with interest capitalization. This means that your income will be calculated as follows:

- At the end of the first year, you will receive 10% of $ 1000, i.e. $ 100. The amount on your account has become $ 1100 and 10% will be deducted from it next year. This means compound interest.

- At the end of the second year, you will receive again 10%, but already from $ 1100. This will be $ 1100 + $ 1100/100 * 10 = $ 1100 + $ 110 = $ 1210. A percentage of this amount will be calculated next year.

- Etc. The annual income increases because the amount of fixed capital increases.

This is compound interest. It is interesting because it gives high profits over long periods of time (tens of years).

REGULAR VS COMPOUND INTEREST

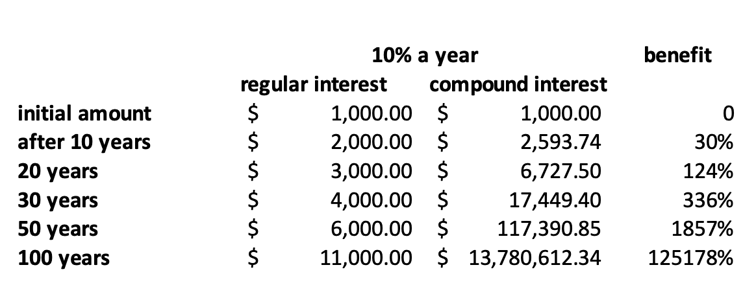

Let's put $ 1000 at 10% at regular and compound interest

Already after 20 years, the difference between ordinary and compound interest becomes more than 2 times, and after 50 years - almost 20 times.

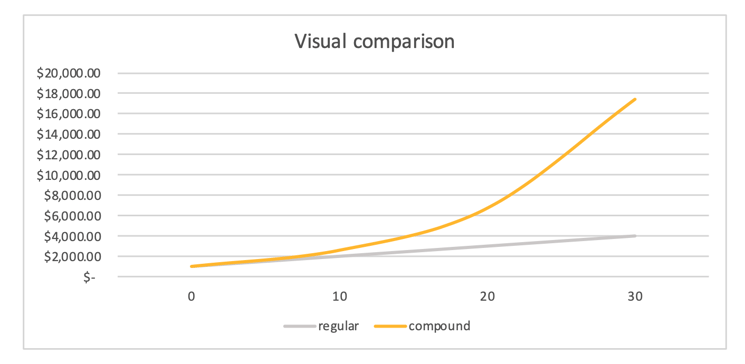

This is how the difference looks on the graph:

At a normal rate of interest, capital grows linearly as you take profits off and keep them from working and generating new profits. With compound interest, capital grows exponentially; over time, the curve of capital growth becomes steeper and more tends upward.

Who is interested in the formula: K u = K n (1 + P / 100%) n

K u is the total capital, K n is the initial capital, P is the interest rate for the settlement period (day, month, year, ...), n is the number settlement periods.

HOW DO I GET COMPOUND INTEREST?

Compound interest works for the investor if he reinvests his income.

For example, if an investor has a rental property, then he needs to constantly invest the rental income (in stocks or other assets). This will give him compound interest.

When buying many funds, reinvestment occurs automatically within the fund - without your participation.

When investing in the stock marker there is usually separate sources of income -

1) growth of invested capital itself (capitalization growth)

2) dividend income (income from company profits' distributed to stake holders)

Dividend income isn't usually represented in historical charts which shows only capitalisation growth. So if you look at S&P500 for example - your profits would be higher than it displays if you choose to re-invest dividends as well.

REAL LIFE

In reality, not everything is so smooth.

Nobody invests for 100 years, and by that time the dollar will become less valuable due to inflation.

Taxes and commissions can arise that can cost hundreds of thousands of dollars (a loss of just 1% out of 10% return reduces the total capital by 17% after 20 years and 37% after 50 years).

And it will be difficult for us to achieve a dollar yield of 10% and the yield will be different in different years (sometimes even a loss). And $ 117,391 in 50 years (as in the table) is not a very large amount.

But not everything is so gloomy.

We can have more than $ 1000 in seed capital and can continually report new funds. We will calmly beat inflation if we make a competent investment portfolio. Taxes and commissions can be minimized.

And 30-50 years is a sufficient period to form a personal pension fund. Compound interest is becoming even more relevant with the development of medicine and the increase in life expectancy.

FINDINGS

Compound interest is not a fairy tale in which capital itself appears, but over long periods of time it gives a very pleasant return.

Compound interest is about getting rich slowly but steadily.

To get the most out of compound interest, invest:

- as soon as possible

- with minimal costs

- into assets that outpace inflation

- not only the initial amount, but also additional funds

- all return on investment back into investment

But first, create a financial cushion.

Well, take care of your health in order to live more and experience the maximum effect of compound interest.