Why tactical asset allocation

As investors, we are looking to preserve our capital as our first goal. The key is - we NEED the capital to make profits. No capital - NO gains. So making a profit is only the second objection of investing.

As investors, we are looking to preserve our capital as our first goal. The key is - we NEED the capital to make profits. No capital - NO gains. So making a profit is only the second objection of investing.

ETF stands for exchange-traded fund.

We believe that an investor should have a decent amount of curiosity, be open-minded and learn new things quickly as the financial tools landscape keeps changing. But in this article we want to warn about investment instruments which most likely lead to losing money rather than building wealth.

Although financial markets are usually very well regulated the world is not the perfect place and periodically huge scams are revealed even in this area.

To get money (for an apartment, car, pension), you need to save it. The question is how much?

There are three stages of achieving financial freedom:

Compound Interest is the most powerful force in the universe

Albert Einstein

In 2008, billionaire Warren Buffett wagered $ 1 million with hedge fund managers (actively-managed funds with high commissions).

Warren Buffett is the richest financier in the world, his investments have brought him a fortune of $ 76 billion (at the moment). In the ranking of the richest financiers, he takes 1st place by a wide margin, and in 2008 he was the richest man in the world according to Forbes.

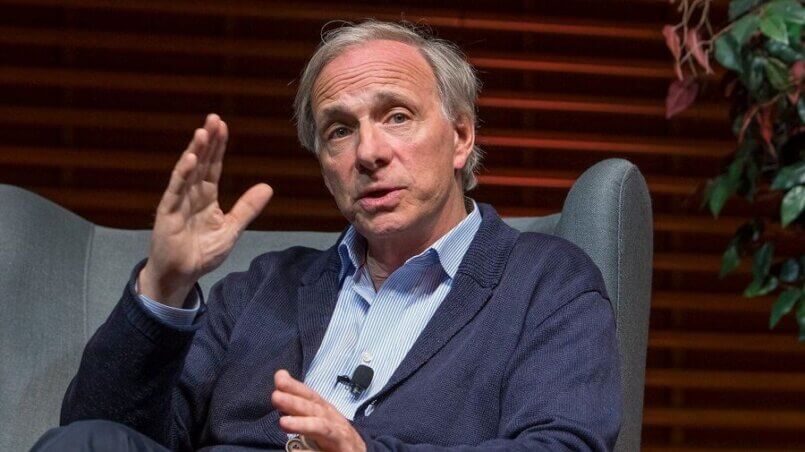

Soros was once the King of speculation, but today's King is probably Ray Dalio, founder of the world's largest hedge fund and author of the famous How the Economic Machine Works video .