Ray Dalio advises passive investments

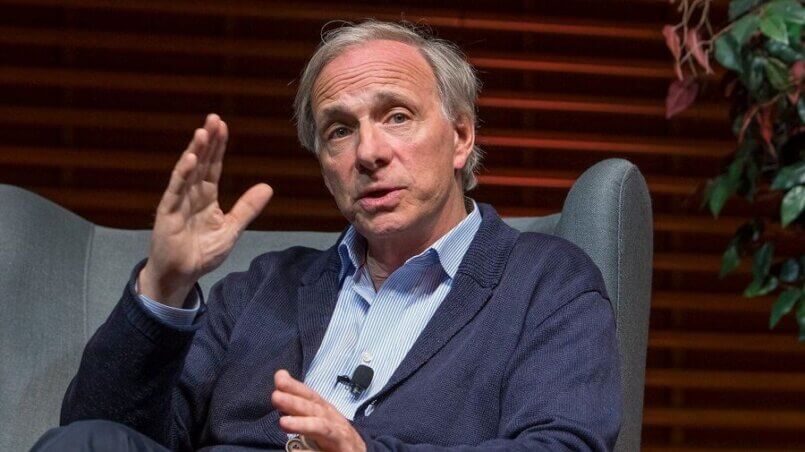

Soros was once the King of speculation, but today's King is probably Ray Dalio, founder of the world's largest hedge fund and author of the famous How the Economic Machine Works video .

And the most interesting thing is that after Buffett, he recommends investors not to compete in speculation or active investment.

In the book "Money. Master of the Game" Dalio advises Tony Robbins not to even try to make a super profit in the stock market, because almost no one can do it.

Ray says he has a hard time doing it despite 1,500 employees and 40 years of experience, so he advises learning passive ways to win based on diversification.

Here's what he said in a TED interview:

First of all, an investor must understand that they probably will not be able to play the game well. They probably will not be able to decide how to move in and out of things.

An order to be successful in the market is more difficult than getting a gold medal in the Olympics (we are talking about speculation and active trading, not ordinary investments).

You wouldn't think about competing at the Olympics, but everybody thinks they can compete in the markets.

There is more money competing. It's like a zero-sum game (where the winner's win is the loser's loss) and there is more money doing it and the worst thing you could do is think you can time all these movements.

I guarantee the game is a tough game. We put hundreds of millions of dollars into the game every year (in market research). And it's tough.

So what's the individual investor needs to do is know how to diversify well. And in a balanced way (across asset classes, across countries and currencies)

GLOBAL POKER

Dalio compares trading in the marketplace to playing poker against some of the best and most experienced players on the planet who have almost unlimited resources.

In theory, you can temporarily win on luck (like in a casino), but in the end you will have a sad outcome.

Mathematicians would say that for you this is a game with negative mathematical expectation (minus in the distance). It's like going into the ring with Tyson, sooner or later - a knockout.

DECEIVING SIMPLICITY

Outwardly, it seems that it is not so difficult to “trade well”, because the numbers are just jumping on the screen and you just need to click correctly a couple of times with the mouse ...

Some people simply invest in companies that they like emotionally or conduct superficial analytics that they somehow feel are enough to beat the pros.

But this simplicity is deceiving, because on the other end of the board there are billions of dollars that calculate every step and are aimed at taking your money away. You are playing against grandmasters and your chances are low.

HOW TO WIN?

The most insidious and cunning strategy is not to play against them, because you have to choose your battles.

As Sun Tzu wrote in his treatise on war, "He who knows when he can fight, and when he cannot, will be the winner."

For example, I will never play billiards with Stalev or chess with Kasparov for money. Well, if only for a little money, which is worth a cultural experience.

There is no cultural experience on the stock exchange, so doing charity work for Wall Street is pointless.

ARE THEY CHEATING ON ME?

You might be thinking: why would the speculator Dalio and the active investor Buffett care so much about me?

Maybe trading is a “gold mine” and they are specifically discouraging me?

In this case, all the big financiers would be promoting passive investment. But no, only Buffett and Dalio do it.

In fact, on the contrary, it is beneficial for them to attract newcomers to the market , because the vast majority of players lose.

But they do not urge anyone to trade and there are several explanations for this:

1) Dalio and Buffett are too “well fed”. Both have already made a name and fortune for themselves, entered all kinds of Forbes lists and provided all generations of their descendants.

2) Do not overestimate their influence on the masses. Well, they would call to speculate in their interviews - it is not a fact that this would bring tangible benefits. And so they will get likes for being true, because the institution of reputation is developed in the West.

All financial media and brokers are promoting active trading anyway.

3) Dalio is 71 and Buffett is 90 (at the time of this writing). At this age, many entrepreneurs think more about legacy than any tricks to snatch an extra billion before dying.

Therefore, I don't see any catch. But the question itself is correct, because you need to think for yourself, and not trust someone blindly because of his status and reputation.

LOSSES

If you want to play on the stock exchange , I will not strongly discourage you, but this is almost guaranteed lost money and time, including in the "compound interest effect".

It is better to start winning immediately in a passive way through diversification, receiving income from economic growth and achieving your financial goals.

Dalio correctly said that you need to invest in different types of assets and different countries, but forgot to mention the most basic way of diversification - indices (but Buffett likes to talk about them, who advises them to his friends).

INDEXES

The fact is that buying a separate company is quite risky. Even with such beautiful names as Google and Apple, because any successful company can plummet in price:

- energy giant Enron has been hailed as America's most innovative company, but it went bankrupt when the reporting fraud was revealed.

- many IT companies were once at their peak, and now hardly anyone will remember their names.

There is always a risk that something will go wrong in a particular company. Or that you bought shares of a company for a high price and they will bring you below average profitability (or even a loss). This is where indexes come in.

In short, this is a list of tens or hundreds of the largest companies in the country in a certain proportion. And there are funds that copy such indices.

You invest in such an index fund and through it you own many companies. In essence, this is how you guarantee yourself the average market return.