Choosing proper ETFs

What is an ETF

ETF stands for exchange-traded fund.

Imagine if you had a portfolio of classical assets like stocks and bonds. Now imagine that this portfolio is split into multiple parts - shares and these shares are traded on an exchange. This roughly would be an ETF.

How ETFs are differ

EFTs can consist of assets of different types:

-

stocks, bonds, commodities, real-estate (via REIT), etc

They also can consist of assets of different sectors:

-

insurance, green economy, space, etc

ETFs could be quoted in different currencies:

-

USD, EUR, GBP, etc

They could give exposure to the economy of a single country, group of countries (e.g. emerging markets), or the whole world.

They can just follow an index like S&P500 or NASDAQ. Or be more actively managed.

ETFs can accumulate dividends and coupons or distribute them equally among fund holders.

ETFs are managed by different financial companies, among which are:

-

iShares (BlackRock), Vanguard, State Street SPDR, Invesco, Charles Shwab

Benefits for investors

As we already know - passive investments are probably the best choice if you want to profit from overall economic growth and technological progress without spending your time on particular company analysis or figuring a trading strategy and so on.

In this case, ETFs could become a very convenient choice. Most of them provide very good diversification by design, they are simple to use, and they are significantly cheaper than other similar investment instruments (e.g. mutual funds)

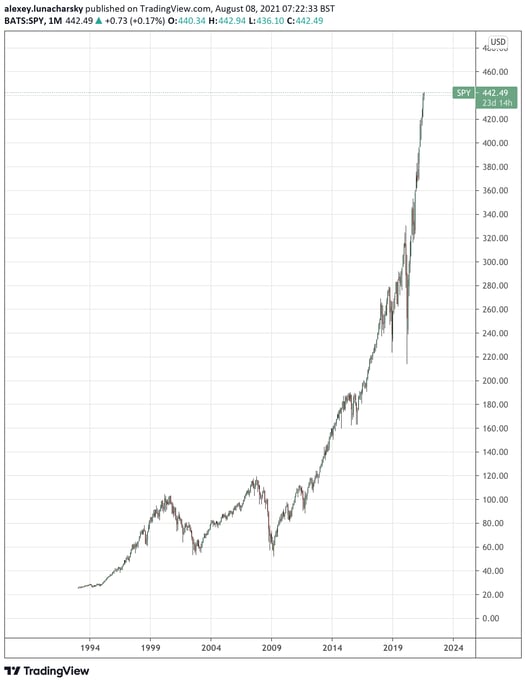

For example, let's assume you wanted to invest in the 500 biggest US companies.

You could simply buy as many SPY shares as you like, and the extra cost of keeping this portfolio for you would be only 0.09% of your invested amount per annum.

Here is the growth that you could get (including dividends re-investing) in almost 30 last years.

Or you wanted to invest in Russian economic growth? In this case, you need something like ERUS with a cost of 0.59% per annum.

How to choose an ETF

Ok, I hope you agree that EFTs are great and thinking about using them as part of your investment plan if you don't already. But how can you make a proper choice?

The first thing to know here is there multiple resources available to find and pick what you need, https://etfdb.com/, https://www.justetf.com/ for instance.

What things do you need to pay attention to?

- Assets under management - the more money a fund has the easier it is for the fund to adhere its selected strategy (for example buying all stocks in an index in necessary proportion)

- Fees - ETFs have become very popular and chances are multiple management companies provide the fund you are looking for. As an investor, you should be looking to pay fewer maintenance fees.

- Fund domicile - matters for legislation and regulation. For example, US funds are obliged to distribute dividends and coupons to investors. Where EU funds might choose to be distributing funds or accumulating funds. Depending on where is your tax residence one choice or another may be more beneficial to you. If you want to know more, we suggest speaking to your tax consultant about it as this is a separate and very complex topic.

- Following precision - each fund is managed by some entity, they can do a better or worse job in the execution of following the underlying index or strategy. In general, you should prefer ETFs with the highest precision.

- Liquidity - even if you buy/sell funds very rarely, it is a good idea to pick a fund with high liquidity to make sure you can easily enter/exit the market when you like. For this look and compare Avg. Volume (1 Month, 3 Month, etc) fund characteristics.

If you want to go deeper it might also make sense to read through a fund's prospect to see if your expectations about what managers will do with your capital are matched.

Pro tip 💡 Many brokers have flat fee when buying/selling ETFs (such as 0.02$). If you're broker do the same you can save more if buying equivalent ETF with a higher share price

When "buy and hold" is not enough

ETFs can be used not only for simple buy and hold (although this is recommended and sufficient for most investors). If you want to create a more efficient investment portfolio from ETFs - consider using quantitative investment approaches such as https://allocatesmartly.com. Using these modern statistically verified and backtested strategies you could significantly reduce your market risks without sacrificing profit.

References

https://www.investopedia.com/terms/e/etf.asp

https://money.usnews.com/investing/funds/slideshows/best-etfs-to-buy?slide=8

https://allocatesmartly.com/faqs/#what-we-trade